How To Deal With Restaurant Cash Flow Problems, Managing Your Café'S Cash Flow

If you’re thinking of creating a cash flow forecast, it helps to see an exact real-world example. How do other businesses make them effectively? What do they include? How are they formatted?

In this article, I’m going to show you a cash flow forecast in a standard format used by thousands (probably millions) of businesses across the world.

It’s an example coffee shop built in travelhome.vn financial forecasting software but it can also be created using our free spreadsheet template.

Đang xem: How to deal with restaurant cash flow problems

We’ll be going through this section by section, line by line, so you can understand how it really works.

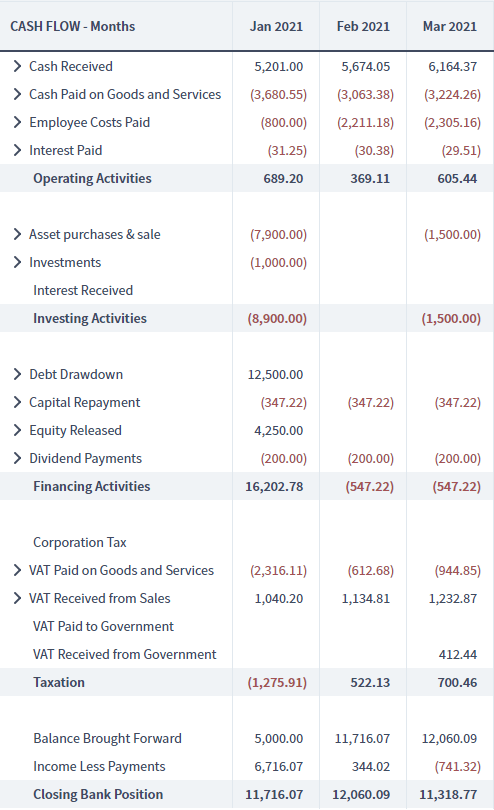

Cash Flow Forecast Example

A full cash flow statement split into Operating Activities, Investing Activities, Financing Activities, Taxation and the Bottom lines

You are probably used to looking at your bank statement. This is actually a type of cash flow report, showing a chronological breakdown of the cash inflows and outflows for a period.

A full cash flow statement is more useful since it categorises these inflows and outflows.

Different time frames and granularities are useful for different purposes. This example is a multiple year forecast split out by months. Seasonal businesses need to plan ahead in this way to avoid cash flow problems in the future.

This starts with three broad categories:

Operating activities – your day to day sales and running costsInvesting activities – less frequent spending aimed at investing into future growthFinancing activities – receiving or paying back funding sources

Keeping Investing activities and Financing activities distinct from the everyday business activities (Operating activities) is key for good cash flow planning.

If your funding sources get mixed in with cash from sales, it can be difficult to see your true performance and might mean risks in the business remain hidden.

It’s said that cash flow kills businesses and keeping your finances visible is one measure to avoid this.

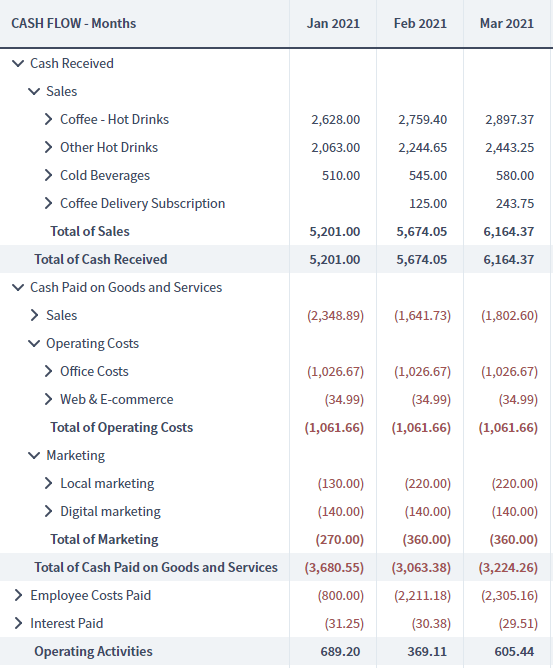

What goes into operating activities?

Here Operating Activities have been opened up to reveal some of the common transactions that impact this coffee shop every day

The first section of a cash flow forecast shows how the business generates cash through your normal operations.

Looking at the cash flow from your operating activities line by line allows you to identify where the biggest costs from your business comes from.

Cash received: This is the total cash from your customers. For this coffee shop, that’s all the food and drink being sold. Cash Paid on Goods and Services: Money paid out to suppliers. In this example, it includes spending on ingredients like coffee beans as well as running costs like rent.Interest Paid: The regular cost of funding activities like bank loans. The receipt of the loan drawdown and repayment of the principle goes into Financing Activities but the actual on-going cost in interest comes into Operating Activities.

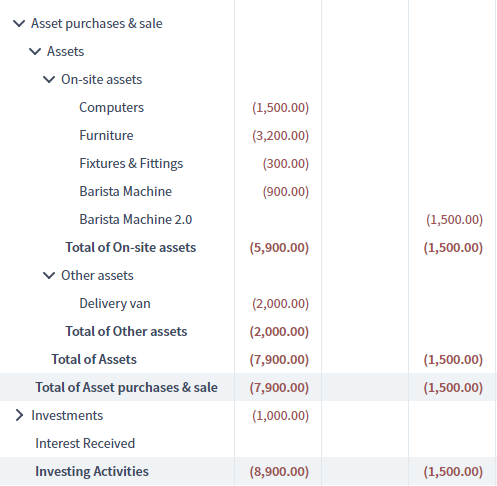

What goes into investing activities?

Opening up Investing Activities reveals some of the asset purchases this business is making to support and grow the business long term.

Investing activities include any money you spent or received from assets, credit agreements, or any other investments you make. Purchasing new equipment, fixtures or even entire buildings often shows that a business is spending on growth and expansion.

Asset purchases & sale: Assets range from equipment to vehicles to entire buildings and everything in between. For this coffee shop, it’ll be items like barista equipment, kitchen equipment, tables etc. On the cash flow, you see the purchase amount (or the money received from selling an asset later on). Investments: Businesses can invest surplus cash into funds, other businesses or any activity that puts their extra cash to work. Money moved in or out in this way appears on this line. Interest Received: Surplus cash sitting in savings accounts will generate cash from interest.

What goes into Financing Activities?

Financing activities show the funding come into the business and the debt that is paid back over time.

Xem thêm: blue sea vung tau

This area of your cash flow forecast identifies how your business is being funded and how your cash requirements are being fulfilled.

With operating and Investing activities split out, your forecast will show you if you need any funding to cover them. This can then be planned in the financing activities section of your projections.

You’ll also be able to establish how much debt you’ll actually be able to afford.

You may need to take out a line of credit to bridge gaps in your cash flow, but debt can be crippling for startups if you can’t afford the repayments. This is another reason it’s important to separate lines of credit out from your day to day activities.

Debt Drawdown: This line shows you how much cash you’ve received from any loans you have. Capital Repayment: This shows you how much debt you pay back each month. For instance, the monthly repayments for my loan are £347.22. Equity Released: Money injected into the business from investors (including the business owner) appears here.Dividend Payments: Dividends payments are often regular payments to investors.

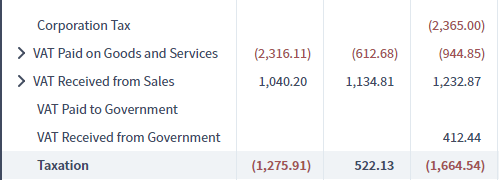

What goes into Taxation?

Tax has a huge impact on the cash flow of most businesses. On this cash flow statement, it’s split out from the rest of the business activities to make it abundantly clear.

After the core activities, we’ve got an important area on taxation. In some cash flow reports this is rolled into the core areas – here we’ve split it out so that it’s distinct.

Xem thêm: xe khách bắc giang hải phòng

Again, it’s useful to split out from normal activities because the tax bill can catch you off guard if it’s hidden.

Bình luận